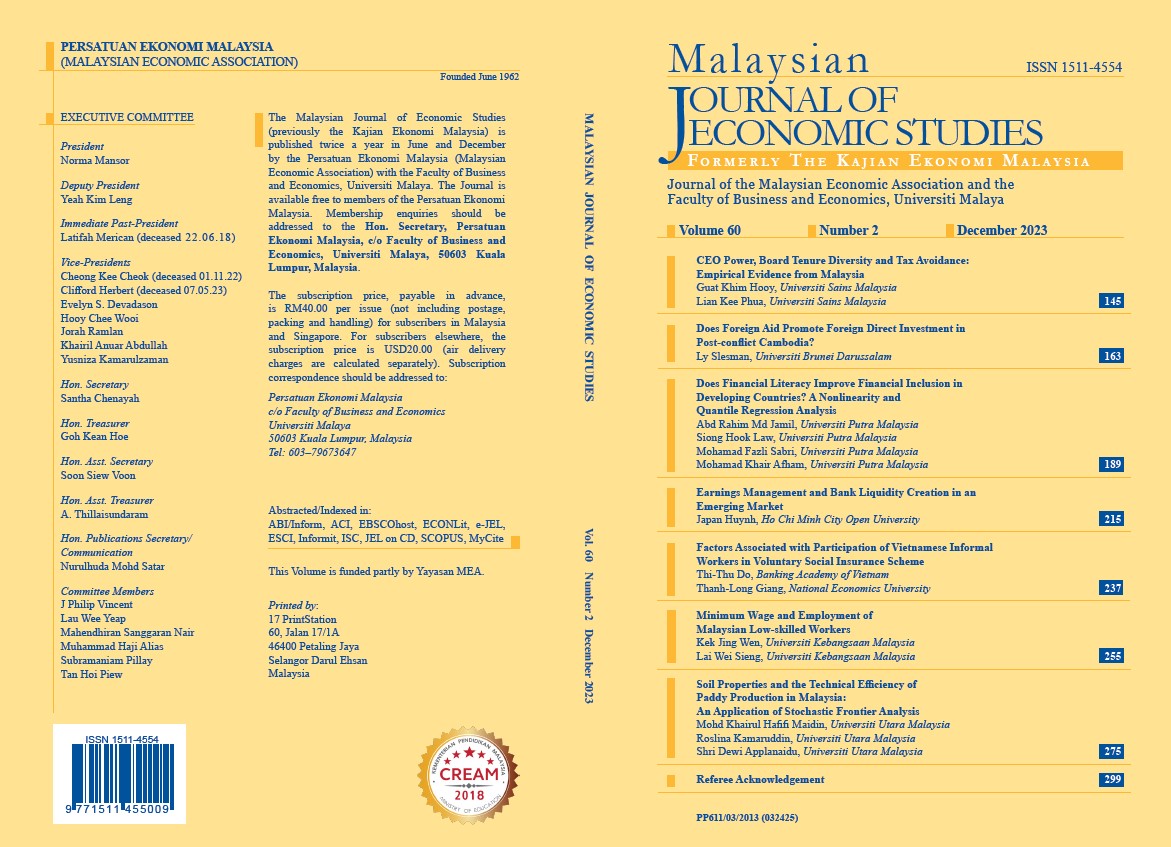

Does Financial Literacy Improve Financial Inclusion in Developing Countries? A Nonlinearity and Quantile Regression Analysis

DOI:

https://doi.org/10.22452/MJES.vol60no2.3Keywords:

Financial literacy, financial inclusion, threshold estimation, quantile regression estimationAbstract

This study investigated the nexus between financial literacy and financial inclusion using the cross-section threshold regression model and the quantile regression technique. The sample covered 73 developing countries categorised as lower-middleincome or upper-middle-income economies. The main results of the threshold model revealed that financial literacy had no inverted U-shaped effect on financial inclusion in the sample of developing countries. This situation indicated that financial literacy had a linear or monotone relationship with financial inclusion. The quantile regression model was used to compare the findings in this investigation. The empirical result indicated that the financial literacy variable had a limited impact on the conditional distribution of financial inclusion. However, the coefficient values were much larger at high than low quantiles. This study’s results are necessary for policymakers and financial institutions to implement financial literacy programs targeted at specific behaviours and underserved populations in developing countries.