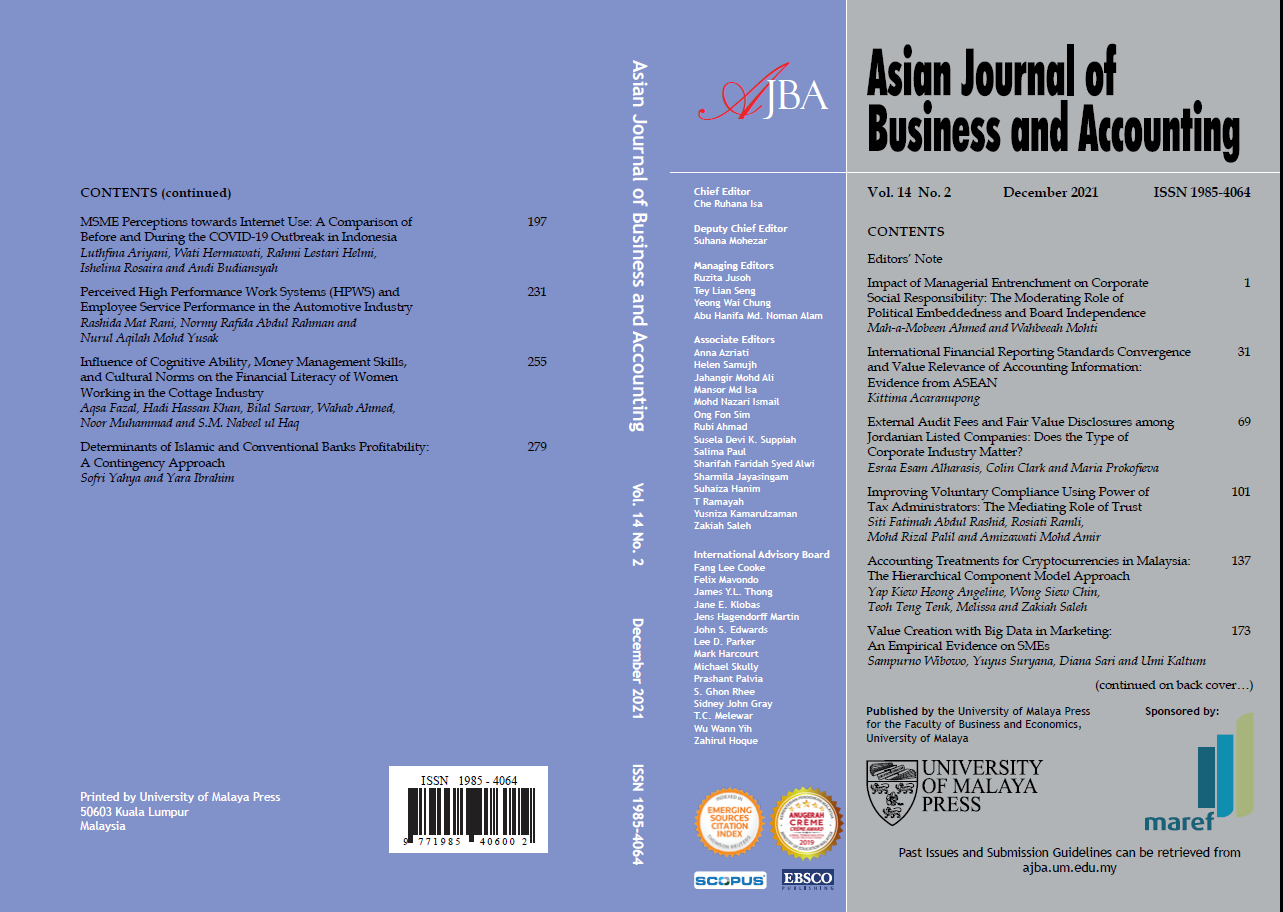

External Audit Fees and Fair Value Disclosures among Jordanian Listed Companies: Does the Type of Corporate Industry Matter?

DOI:

https://doi.org/10.22452/ajba.vol14no2.3Abstract

ABSTRACT

Manuscript type: Research paper

Research aims: This paper investigates industry differences associated with audit fees charged by Jordanian external auditors, who

provide assurance for clients’ financial disclosures following the introduction of the fair value accounting (FVA) instrument.

Design/Methodology/Approach: The study uses 2408 firm-year observations among Jordanian firms for the period between 2005–2018, and employs the ordinary least squares (OLS) regression method.

Research findings: A significant and positive difference in the correlation between the proportion of FVA and audit prices was evident

for the finance industry vs. non-finance industries. Specifically, the moderating impact of the industry type was positively (negative)

correlated in relation to the Level 2 (Level 1) fair-valued assets, but not significant for Level 3 assets.

Theoretical contribution/Originality: This study is an opportunity to document important empirical evidence for a country with varied economic features, regulations, and an environment which is considered representative of Arab countries and the Middle East (ME), i.e., Jordan. It introduces an updated model on audit fees and new empirical evidence addressing the gap among auditing literature works by investigating the post-implementation cost of FVA amongst different industries. This study pioneers audit research

and triangulates the agency, signalling and stakeholder theories associated with the fair value model.

Practitioner/Policy implication: The findings provide policymakers and standard setters with updated empirical evidence on the implications of fair value disclosure (FVD). It provides guidance on audit fee determinants arising from fair value financial reporting. The outcomes are meant to assist Jordanian authorities for supervising the audit profession, as well as regulating and auditing these fair value practices.

Keywords: Auditing Fair Value Accounting, Audit Fees, Corporate Industry Type, Developing Countries, Fair Value Disclosure, Jordan

JEL Classification: M41, M42