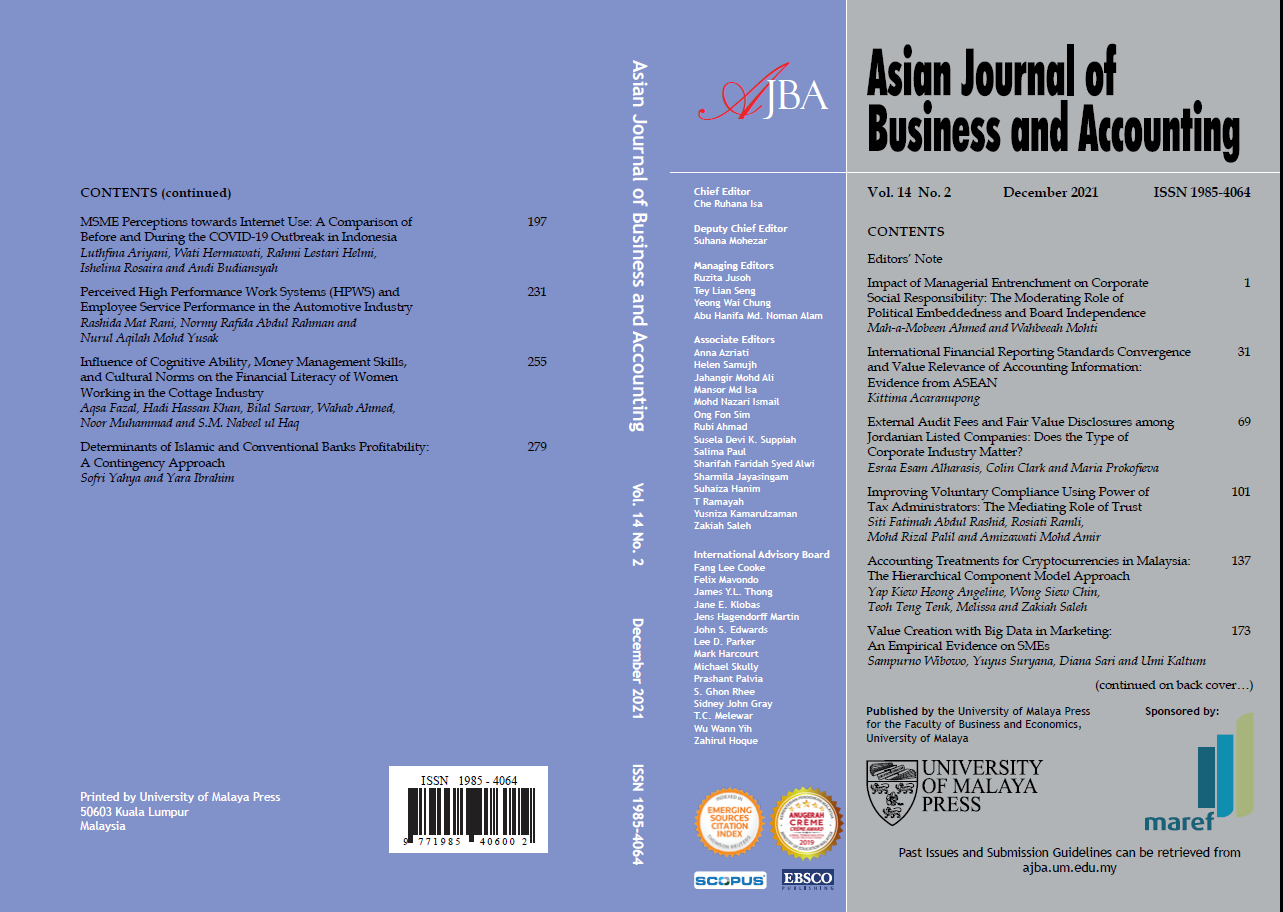

International Financial Reporting Standards Convergence and Value Relevance of Accounting Information: Evidence from ASEAN

DOI:

https://doi.org/10.22452/ajba.vol14no2.2Abstract

ABSTRACT

Manuscript type: Research paper

Research aims: This study aims to examine and compare the value relevance of accounting information of companies listed on the stock exchanges in Indonesia, Malaysia, the Philippines, Singapore, and Thailand, after the International Financial Reporting Standards (IFRS) adoption period.

Design/Methodology/Approach: This study utilised a regression model as the primary method of analysis. The regression model

was adopted from Ohlson (1995) and Feltham and Ohlson (1995). Value relevance was measured in terms of the relationship between

accounting information and stock price. The high trading volume and large market capitalisation listed companies of five member countries in the Association of Southeast Asian Nations (ASEAN) were used as samples for the study.

Research findings: The main results demonstrate that earnings are value relevant information in four countries (Indonesia, Malaysia,

the Philippines, and Thailand). However, the book value of equity is value relevant information for only three countries (Indonesia,

Singapore, and Thailand). Contradicting findings are obtained because of the high correlation between earnings and book value of

equity. The results of the comparative value relevance of earningsand book value of equity indicate that the value relevance of earnings in Malaysia is more than that of Thailand, while the value relevance of earnings in the Philippines and Singapore is less than that of Thailand. However, the value relevance of earnings in Indonesia is not different from Thailand. In addition, the value relevance of book value of equity in Indonesia, the Philippines, and Singapore is more than that of Thailand, while the value relevance of book value of equity in Malaysia is not different from that of Thailand.

Theoretical contribution/Originality: The findings contribute to the accounting theory and literature by indicating that the IFRS adoption enhances the value relevance of accounting information, especially in ASEAN countries.

Practitioner/Policy implication: The results provide policy directions to the accounting standard setting bodies of five countries in ASEAN for further improvement in their local accounting standards.

Research limitation/Implication: The accounting information quality in this research was measured only in terms of value relevance. In addition, the study considers the high market capitalisation firms in only five countries, which limit the generalisation of the results to other countries.

Keywords: ASEAN, International Financial Reporting Standards, Value Relevance

JEL Classification: M41, G14