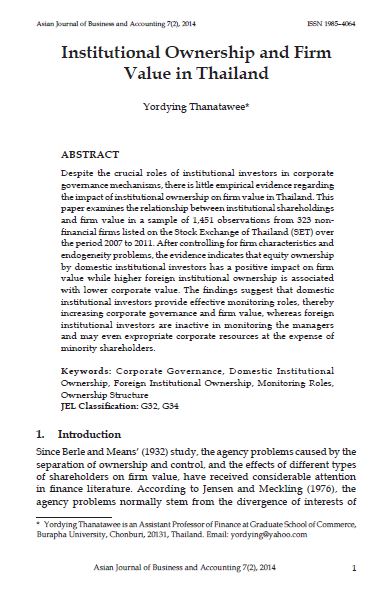

Institutional Ownership and Firm Value in Thailand

Abstract

Despite the crucial roles of institutional investors in corporate governance mechanisms, there is little empirical evidence regarding the impact of institutional ownership on firm value in Thailand. This paper examines the relationship between institutional shareholdings and firm value in a sample of 1,451 observations from 323 non-financial firms listed on the Stock Exchange of Thailand (SET) over the period 2007 to 2011. After controlling for firm characteristics and endogeneity problems, the evidence indicates that equity ownership by domestic institutional investors has a positive impact on firm value while higher foreign institutional ownership is associated with lower corporate value. The findings suggest that domestic institutional investors provide effective monitoring roles, thereby increasing corporate governance and firm value, whereas foreign institutional investors are inactive in monitoring the managers and may even expropriate corporate resources at the expense of minority shareholders.

Keywords: Corporate Governance, Domestic Institutional Ownership, Foreign Institutional Ownership, Monitoring Roles, Ownership Structure

JEL Classification: G32, G34

Downloads